DEF 14A: Definitive proxy statements

Published on April 28, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(AMENDMENT NO. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

SUTRO BIOPHARMA, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

SUTRO BIOPHARMA, INC.

111 Oyster Point Boulevard

South San Francisco, California, 94080

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 8, 2023

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Stockholders of Sutro Biopharma, Inc. will be held via a virtual meeting. You will be able to participate in the 2023 Annual Meeting and vote during the 2023 Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/STRO2023 on Thursday, June 8, 2023 at 12:00 p.m. (Pacific Time). We believe that a virtual stockholder meeting provides greater access to those who may want to attend, and therefore we have chosen this over an in-person meeting. It is important that you retain a copy of the control number found on the proxy card or voting instruction form, or included in the e-mail to you if you received the proxy materials by e-mail, as such number will be required in order for stockholders to gain access to the virtual meeting.

We are holding the meeting for the following purposes, which are more fully described in the accompanying proxy statement:

In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

Only stockholders of record at the close of business on April 20, 2023 are entitled to receive notice of, and to vote at, the meeting and any adjournments thereof. This Notice and the accompanying proxy statement are being mailed out to stockholders as of the record date beginning on or about April 28, 2023.

For ten days prior to the meeting, a complete list of the stockholders entitled to vote at the meeting will be available upon request by any stockholder for any purpose relating to the meeting. Stockholders can request the list of stockholders through our investor relations website at https://ir.sutrobio.com/contact-ir.

Your vote as a Sutro Biopharma, Inc. stockholder is very important. Each share of common stock that you own represents one vote.

For questions regarding your stock ownership, you may contact our Vice President, Finance, Regina Cheng at (650) 676-4686 or rcheng@sutrobio.com or, if you are a registered holder, our transfer agent, American Stock Transfer & Trust Company, LLC by email through their website at https://www.astfinancial.com or by phone at (800) 937-5449. Whether or not you expect to attend the meeting, we encourage you to read the proxy statement and vote through the internet or by telephone, or to request, sign and return your proxy card as soon as possible, so that your shares may be represented at the meeting. For specific instructions on how to vote your shares, please refer to the section entitled “General Proxy Information” in the proxy statement.

|

|

By Order of the Board of Directors, |

|

|

William J. Newell |

Chief Executive Officer |

South San Francisco, California

April 28, 2023

Important Notice Regarding the Availability of Proxy Materials for the virtual Annual Meeting of Stockholders to be held on June 8, 2023: the Proxy Statement and our 2022 Annual Report on Form 10-K are available at http://ir.sutrobio.com. You will need the control number included on your proxy card or voting instruction form, or included in the e-mail to you if you received the proxy materials by e-mail, as such number will be required in order for stockholders to gain access to the virtual meeting.

SUTRO BIOPHARMA, INC.

PROXY STATEMENT FOR 2023 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

|

|

|

|

|

|

|

Page |

|

|

|

1 |

|

|

|

|

|

|||

|

1 |

|

|

|

|

|

|||

|

1 |

|

|

|

|

|

|||

|

2 |

|

|

|

|

|

|||

|

5 |

|

|

|

|

|

|||

|

11 |

|

|

|

|

|

|||

PROPOSAL NO. 2 RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

16 |

|

|

|

|

|||

|

17 |

|

|

|

|

|

|||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

18 |

|

|

|

|

|||

|

20 |

|

|

|

|

|

|||

|

22 |

|

|

|

|

|

|||

|

35 |

|

|

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|||

PROPOSAL NO. 3 NON-BINDING ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

|

38 |

|

|

|

||||

PROPOSAL NO. 4 AMENDMENT TO CERTIFICATE OF INCORPORATION |

|

39 |

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|||

|

41 |

|

|

|

|

|

|||

|

42 |

|

|

|

|

|

|

|

|

|

43 |

|

|

|

SUTRO BIOPHARMA, INC.

111 Oyster Point Boulevard

South San Francisco, California, 94080

PROXY STATEMENT FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

April 28, 2023

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the Board of Directors of Sutro Biopharma, Inc. (Sutro Biopharma or the Company) for use at Sutro Biopharma’s 2023 Annual Meeting of Stockholders (Annual Meeting) to be held via a virtual meeting. You will be able to participate in the Annual Meeting and vote during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/STRO2023 on Thursday, June 8, 2023 at 12:00 p.m. (Pacific Time), and any adjournment or postponement thereof. We believe that a virtual stockholder meeting provides greater access to those who may want to attend, and therefore we have chosen this over an in-person meeting. You will need the control number included on your proxy card or voting instruction form, or included in the e-mail to you if you received the proxy materials by e-mail, as such number will be required in order for stockholders to gain access to the virtual meeting. We are making this proxy statement, the accompanying form of proxy and our Annual Report on Form 10‑K for the year ended December 31, 2022 first available to stockholders on or about April 28, 2023. An electronic copy of this proxy statement and Annual Report on Form 10‑K are available at http://ir.sutrobio.com.

INTERNET AVAILABILITY OF PROXY MATERIALS

Under rules adopted by the Securities and Exchange Commission (the “SEC”), we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies to each stockholder. On or about April 28, 2023, we expect to send to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) containing instructions on how to access our proxy materials, including our proxy statement and our Annual Report on Form 10-K. The Notice of Internet Availability also provides instructions on how to vote and includes instructions on how to receive paper copies of the proxy materials by mail, or an electronic copy of the proxy materials by email.

This process is designed to reduce our environmental impact and lower the costs of printing and distributing our proxy materials while providing our stockholders timely access to this important information. If you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability.

GENERAL INFORMATION ABOUT THE MEETING

Purpose of the Meeting

At the meeting, stockholders will act upon the proposals described in this proxy statement. In addition, we will consider any other matters that are properly presented for a vote at the meeting. We are not aware of any other matters to be submitted for consideration at the meeting. If any other matters are properly presented for a vote at the meeting, the persons named in the proxy, who are officers of the company, have the authority in their discretion to vote the shares represented by the proxy.

Record Date; Quorum

Only holders of record of common stock at the close of business on April 20, 2023, the record date, will be entitled to vote at the meeting. At the close of business on April 20, 2023, 60,191,880 shares of common stock were outstanding and entitled to vote.

The holders of a majority of the voting power of the shares of stock entitled to vote at the meeting as of the record date must be present or represented by proxy at the meeting in order to hold the meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the meeting if you are present and vote online at the virtual meeting or if you have properly submitted a proxy.

1

GENERAL PROXY INFORMATION

Voting Rights; Required Vote

Each holder of shares of common stock is entitled to one vote for each share of common stock held as of the close of business on April 20, 2023, the record date. You may vote all shares owned by you at such date, including (1) shares held directly in your name as the stockholder of record and (2) shares held for you as the beneficial owner in street name through a broker, bank, trustee or other nominee. Dissenters’ rights are not applicable to any of the matters being voted on.

Stockholder of Record: Shares Registered in Your Name. If on April 20, 2023, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the meeting, or vote in advance through the internet or by telephone, or if you request to receive paper proxy materials by mail, by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee. If on April 20, 2023, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your broker on how to vote the shares held in your account, and your broker has enclosed or provided voting instructions for you to use in directing it on how to vote your shares. Because the brokerage firm, bank or other nominee that holds your shares is the stockholder of record, if you wish to attend the meeting and vote your shares, you must obtain a valid proxy from the firm that holds your shares giving you the right to vote the shares at the meeting.

Each director will be elected by a plurality of the votes cast by the holders of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. This means that the three individuals nominated for election to the Board of Directors at the meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” one, two, three or all of the nominees or “WITHHOLD” your vote with respect to one, two, three or all of the nominees. A “WITHHOLD” will have the same effect as an abstention. You may not cumulate votes in the election of directors. Approval of the ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of the holders of a majority of the voting power of the shares of stock entitled to vote on such matter that are present in person or represented by proxy at the meeting and are voted for or against the matter. Approval, on a non-binding advisory basis, of the compensation of our named executive officers requires the affirmative vote of the holders of a majority of the voting power of the shares of stock entitled to vote on such matter that are present in person or represented by proxy at the meeting and are voted for or against the matter. Approval of the amendment and restatement of the Certificate of Incorporation, requires the affirmative vote of the holders of a majority of the voting power of all of the outstanding shares of common stock. Shares that are voted “abstain” are treated as the same as voting “against” this proposal.

A proxy submitted by a stockholder may indicate that the shares represented by the proxy are not being voted (stockholder withholding) with respect to a particular matter. In addition, a broker may not be permitted to vote on shares held in street name on a particular matter in the absence of instructions from the beneficial owner of the stock (broker non-vote). At this meeting, only the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, is considered a routine matter. The other proposals presented at the meeting are non-routine matters. The shares subject to a proxy which are not being voted on a particular matter because of either stockholder withholding or broker non-votes will count for purposes of determining the presence of a quorum, but are not treated as votes cast and, therefore, will have no effect on the election of directors or the ratification of the appointment of Ernst & Young LLP, but will have the effect of an “against” vote for the proposal to approve the Amended and Restated Certificate of Incorporation. Abstentions are voted neither “for” nor “against” a matter, and, therefore, will have no effect on the outcome of will have no effect on the election of directors or the ratification of the appointment of Ernst & Young LLP, but will have the effect of an “against” vote for the proposal to approve the Amended and Restated Certificate of Incorporation. Abstentions will also be counted in the determination of a quorum.

Recommendations of the Board of Directors on Each of the Proposals Scheduled to be Voted on at the Meeting

The Board of Directors recommends that you vote FOR the election of each of the Class II directors named in this proxy statement (Proposal 1); FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal 2); FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers, as disclosed in this Proxy Statement (Proposal 3); and FOR the approval of the amendment and restatement of our Certificate of Incorporation (Proposal 4).

None of the directors or executive officers has any substantial interest in any matter to be acted upon, other than elections to office with respect to the directors nominated in Proposal 1.

2

Voting Instructions; Voting of Proxies

If you are a stockholder of record, you may:

Votes submitted through the internet or by telephone must be received by 11:59 p.m., Eastern Time, on June 7, 2023. Submitting your proxy, whether by telephone, through the internet or by mail if you requested or received a paper proxy card, will not affect your right to vote online should you decide to attend the virtual meeting. If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct how to vote your shares. For Proposal 1, you may either vote “FOR” all of the nominees to the Board of Directors, or you may withhold your vote from any nominee you specify. For Proposal 2, you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting. For Proposal 3, you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting. For Proposal 4, you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting. Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure that your vote is counted.

If your shares are held in an account with a brokerage firm, bank or other nominee, then you are deemed to be the beneficial owner of your shares and the broker that actually holds the shares for you is the record holder and is required to vote the shares it holds on your behalf according to your instructions. The proxy materials, as well as voting and revocation instructions, should have been forwarded to you by the bank, broker or other nominee that holds your shares. In order to vote your shares, you will need to follow the instructions that your bank, broker or other nominee provides you. The voting deadlines and availability of telephone and Internet voting for beneficial owners of shares held in street name will depend on the voting processes of the bank, broker or other nominee that holds your shares. Therefore, we urge you to carefully review and follow the voting instruction card and any other materials that you receive from that organization.

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the meeting, your shares will be voted in accordance with the recommendations of our Board of Directors stated above.

If you received a Notice of Internet Availability, please follow the instructions included on the notice on how to access and vote your proxy card. If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described above) and will not be counted in determining the number of shares necessary for approval of the proposals. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the meeting.

If you receive more than one proxy card or Notice of Internet Availability, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on the Notice of Internet Availability on how to access and vote each proxy card. If you requested or received paper proxy materials by mail, please complete, sign, date and return each proxy card to ensure that all of your shares are voted.

Expenses of Soliciting Proxies

We will pay the expenses associated with soliciting proxies. Following the original distribution and mailing of the solicitation materials, we or our agents may solicit proxies by mail, email, telephone, facsimile, by other similar means, or in person. Our directors, officers and other employees, without additional compensation, may solicit proxies personally or in writing, by telephone, email or otherwise. Following the original distribution and mailing of the solicitation materials, we will request brokers, custodians, nominees and other record holders to forward copies of those materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, we, upon the request of the record holders, will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials and/or vote through the internet, you are responsible for any internet access charges you may incur.

3

Revocability of Proxies

A stockholder of record who has given a proxy may revoke it at any time before the closing of the polls by the inspector of elections at the meeting by:

Please note, however, that if your shares are held of record by a brokerage firm, bank or other nominee, and you wish to revoke a proxy, you must contact that firm to revoke or change any prior voting instructions.

Electronic Access to the Proxy Materials

The Notice of Internet Availability will provide you with instructions regarding how to:

Choosing to receive your future proxy materials by email will reduce the impact of our annual meetings of stockholders on the environment and lower the costs of printing and distributing our proxy materials. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Voting Results

Voting results will be tabulated and certified by the inspector of elections appointed for the meeting. The final results will be tallied by the inspector of elections and filed with the SEC in a Current Report on Form 8-K within four business days of the meeting.

4

CORPORATE GOVERNANCE STANDARDS AND DIRECTOR INDEPENDENCE

We are committed to good corporate governance practices. These practices provide an important framework within which our Board of Directors and management pursue our strategic objectives for the benefit of our stockholders.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, Board Committee structure and functions, and other policies for the governance of the company. Our Corporate Governance Guidelines are available without charge on the investor relations section of our website at https://ir.sutrobio.com/corporate-governance/governance-overview.

Board Composition and Leadership Structure

The positions of Chief Executive Officer and Chair of our Board of Directors are held by two different individuals (William J. Newell and Connie Matsui, respectively). This structure allows our Chief Executive Officer to focus on our day-to-day business while our Chair leads our Board of Directors in its fundamental role of providing advice to, and independent oversight of, management. Our Board of Directors believes such separation is appropriate, as it enhances the accountability of the Chief Executive Officer to the Board of Directors and strengthens the independence of the Board of Directors from management. Any changes to the leadership structure of our Board of Directors, if made, will be promptly disclosed on the investor relations section of our website and in our proxy materials. Our Board of Directors, in its sole discretion, may seek input from our stockholders on the leadership structure of the Board of Directors.

Board’s Role in Risk Oversight

Our Board of Directors believes that open communication between management and the Board of Directors is essential for effective risk management and oversight. Our Board of Directors meets with our Chief Executive Officer and other members of the senior management team at regular quarterly Board of Director meetings, and at ad hoc meetings when deemed appropriate, where, among other topics, they discuss strategy and risks in the context of reports from the management team and evaluate the risks inherent in significant transactions. While our Board of Directors is ultimately responsible for risk oversight, our Board Committees assist the Board of Directors in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal controls over financial reporting, disclosure controls and procedures, and information security. The Compensation Committee assists our Board of Directors in assessing risks created by the incentives inherent in our compensation policies. The Nominating and Governance Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to the management of corporate, legal and regulatory risk and environmental, social and governance, or ESG, concerns. The Science and Technology Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to our research and development and platform programs.

Cybersecurity Risk Oversight

Securing the information of participants in our studies, medical professionals, employees, service providers, and other third parties is important to us. We have adopted physical, technological, and administrative controls on data security, and have a defined procedure for data incident detection, containment, response, and remediation. While everyone at our Company plays a part in managing these risks, oversight responsibility is shared by our Board of Directors, our Audit Committee, and management. Our information technology team provides regular cybersecurity updates in the form of written reports and presentations to our Audit Committee. Additionally, we leverage industry standard frameworks to drive strategic direction and maturity improvement. We also engage third-party security experts for risk assessments and program enhancements and maintain information security risk insurance coverage.

5

Director Independence

Our common stock is listed on the Nasdaq Global Market. Under the rules of the Nasdaq Stock Market, independent directors must constitute a majority of a listed company’s Board of Directors. In addition, the rules of the Nasdaq Stock Market require that, subject to specified exceptions, each member of a listed company’s Audit, Compensation and Nominating and Governance Committees must be an “independent director”. Under the rules of the Nasdaq Stock Market, a director will only qualify as an “independent director” if, in the opinion of that company’s Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Additionally, Compensation Committee members must not have a relationship with the listed company that is material to the director’s ability to be independent from management in connection with the duties of a Compensation Committee member.

Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (Exchange Act). In order to be considered independent for purposes of Rule 10A-3, a member of an Audit Committee of a listed company may not, other than in his or her capacity as a member of the Audit Committee, the Board of Directors or any other Board Committee: (i) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (ii) be an affiliated person of the listed company or any of its subsidiaries.

Our Board of Directors has undertaken a review of the independence of each director and considered whether each director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board of Directors determined that Connie Matsui, Michael Dybbs, John Freund, Heidi Hunter, Joseph Lobacki, James Panek, Daniel Petree, and Jon Wigginton representing eight of our nine incumbent directors, are “independent directors” as defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the Nasdaq Stock Market. In making these determinations, our Board of Directors reviewed and discussed information provided by the directors and us with regard to each directors’ business and personal activities and relationships as they may relate to us and our management, including the beneficial ownership of our capital stock by each non-employee director and any affiliates.

Board of Directors and Committee Self-Evaluations

Our Board of Directors is committed to a robust self-evaluation process designed for continuous improvement. To achieve this, our Board of Directors conducts an annual self-evaluation for itself and its committees. As part of this process, each member of the Board of Directors completes a survey to provide feedback on the processes, structure, composition and effectiveness of the Board of the Directors. The survey is a detailed written questionnaire designed to help the Board of Directors assess the performance of the Board of Directors and its committees, their own individual performance and the individual performances of fellow directors. The feedback received is shared first with the Nominating and Corporate Governance Committee, and then made available to the individual directors and the full Board of Directors.

Committees of Our Board of Directors

Our Board of Directors has established an Audit Committee, a Compensation Committee, a Nominating and Governance Committee and a Science and Technology Committee, each of which has the composition and responsibilities described below. Members serve on these Committees until their resignation or until otherwise determined by our Board of Directors. Each of these Committees has a written charter, copies of which are available without charge on the investor relations section of our website at https://ir.sutrobio.com/corporate-governance/governance-overview.

Audit Committee

Our Audit Committee is composed of Ms. Hunter, Dr. Freund, and Mr. Lobacki. Ms. Hunter is the Chair of our Audit Committee. The composition of our Audit Committee meets the requirements for independence under the current Nasdaq Stock Market and SEC rules and regulations. Each member of our Audit Committee is financially literate. In addition, our Board of Directors has determined that Ms. Hunter is an “Audit Committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act. Our Audit Committee is directly responsible for, among other things:

6

Compensation Committee

Our Compensation Committee is composed of Mr. Lobacki, Mr. Petree, and Dr. Wigginton. Mr. Lobacki is the Chair of our Compensation Committee. The composition of our Compensation Committee meets the requirements for independence under the current Nasdaq Stock Market and SEC rules and regulations. Our Compensation Committee is responsible for, among other things:

The Compensation Committee has the sole authority and responsibility, subject to any approval by the Board of Directors which the Compensation Committee or legal counsel determines to be desirable or required by applicable law or the Nasdaq rules, to determine all aspects of executive compensation packages for the Chief Executive Officer and other executive officers. The Compensation Committee also makes recommendations to our Board of Directors regarding the form and amount of compensation of non-employee directors. The Compensation Committee may take into account the recommendations of the Chief Executive Officer with respect to compensation of the other executive officers, and the recommendations of the Board of Directors or any member of the Board of Directors with respect to compensation of the Chief Executive Officer and other executive officers.

The Compensation Committee engaged an independent executive compensation consulting firm, Frederic W. Cook & Co., Inc., or FW Cook, to evaluate our executive compensation and Board of Directors compensation program and practices and to provide advice and ongoing assistance on these matters for the fiscal year ended December 31, 2022. Specifically, FW Cook was engaged to:

Representatives of FW Cook met informally with the Chair of the Compensation Committee and attended the regular meetings of the Compensation Committee, including executive sessions from time to time without any members of management present. During the fiscal year ended December 31, 2022, FW Cook worked with the Compensation Committee to assist the Committee in satisfying its responsibilities and undertook no projects for management without the Committee’s prior approval. The Compensation Committee has determined that none of the work performed by FW Cook during the fiscal year ended December 31, 2022 raised any conflict of interest.

Nominating and Governance Committee

Our Nominating and Governance Committee is composed of Ms. Matsui, Mr. Panek and Mr. Petree. Ms. Matsui is the Chair of our Nominating and Governance Committee. Our Nominating and Governance Committee is responsible for, among other things:

7

Science and Technology Committee

Our Science and Technology Committee is composed of Dr. Wigginton, Dr. Dybbs, Ms. Hunter and Mr. Panek. Dr. Wigginton is the Chair of our Science and Technology Committee. Our Science and Technology Committee is responsible for, among other things:

Code of Business Conduct and Ethics

Our Board of Directors has adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer and other executive and senior financial officers. We intend to disclose future amendments to certain provisions of our code of business conduct, or waivers of these provisions, on our website or in public filings. The full text of our code of business conduct is posted on the investor relations section of our website at https://ir.sutrobio.com/corporate-governance/governance-overview.

Corporate Social Responsibility

We believe that corporate social responsibility (CSR) initiatives are important to our business and to creating sustainable value for our stockholders and wider stakeholder group. Our Board of Directors and management are committed to these initiatives and believe these efforts will benefit our employees, partners, and the communities in which we operate.

Anti-hedging

We have adopted an Insider Trading Policy that applies to all of our employees, officers and directors, including our Chief Executive Officer and other executive officers, which prohibits such individuals from purchasing financial instruments, or otherwise engaging in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in market value of our common stock, such as prepaid variable forward contracts, equity swaps, collars, forward sale contracts and exchange funds.

Compensation Committee Interlocks and Insider Participation

During 2022, Mr. Lobacki, Mr. Petree, and Dr. Wigginton served on our Compensation Committee. None of our current executive officers has served as a member of the Board of Directors, or as a member of the Compensation or similar Committee, of any entity that has one or more executive officers who served on our Board of Directors or Compensation Committee during the fiscal year ended December 31, 2022.

Board and Committee Meetings and Attendance

The Board of Directors and its Committees meet regularly throughout the year and also hold special meetings and act by written consent from time to time. During 2022, the Board of Directors held six meetings including videoconference meetings; the Audit Committee held four meetings; the Compensation Committee held six meetings; the Science and Technology Committee held five meetings; and the Nominating and Governance Committee held four meetings. During 2022, none of the directors attended fewer than 75% of the aggregate of the total number of meetings held by the Board of Directors during his or her tenure and the total number of meetings held by all Committees of the Board of Directors on which such director served during his or her tenure. The independent members of the Board of Directors also meet separately without management directors on a regular basis to discuss such matters as the independent directors consider appropriate.

Board Attendance at Annual Stockholders’ Meeting

We invite and encourage each member of our Board of Directors to attend our annual meetings of stockholders. All of our directors attended our 2022 annual meeting of stockholders, which was held virtually. We do not have a formal policy regarding attendance of our annual meetings of stockholders by the members of our Board of Directors.

8

Communication with Directors

Stockholders and interested parties who wish to communicate with our Board of Directors, non-management members of our Board of Directors as a group, a Committee of the Board of Directors or a specific member of our Board of Directors (including our Chair) may do so by letters addressed to:

Sutro Biopharma, Inc.

c/o Corporate Secretary

111 Oyster Point Boulevard

South San Francisco, California, 94080

All communications by letter addressed to the attention of our Corporate Secretary will be reviewed by the Corporate Secretary and provided to the members of the Board of Directors unless such communications are unsolicited items, sales materials and other routine items and items unrelated to the duties and responsibilities of the Board of Directors.

Considerations in Evaluating Director Nominees

The Nominating and Governance Committee is responsible for identifying, considering and recommending candidates to the Board of Directors for Board membership. A variety of methods are used to identify and evaluate director nominees, with the goal of maintaining and further developing a diverse, experienced and highly qualified Board of Directors. Candidates may come to our attention through current members of our Board of Directors, professional search firms, stockholders or other persons.

The Nominating and Governance Committee will recommend to the Board of Directors for selection all nominees to be proposed by the Board of Directors for election by the stockholders, including approval or recommendation of a slate of director nominees to be proposed by the Board of Directors for election at each annual meeting of stockholders, and will recommend all director nominees to be appointed by the Board of Directors to fill interim director vacancies.

Our Board of Directors encourages selection of directors who will contribute to the company’s overall corporate goals. The Nominating and Governance Committee may from time to time review and recommend to the Board of Directors the desired qualifications, expertise and characteristics of director candidates, including such factors as business experience, diversity and personal skills in life sciences and biotechnology, finance, marketing, financial reporting and other areas that are expected to contribute to an effective Board of Directors. Exceptional candidates who do not meet all of these criteria may still be considered. In evaluating potential candidates for the Board of Directors, the Nominating and Governance Committee considers these factors in the light of the specific needs of the Board of Directors at that time.

In addition, under our Corporate Governance Guidelines, a director is expected to spend the time and effort necessary to properly discharge such director’s responsibilities. Accordingly, a director is expected to regularly attend meetings of the Board of Directors and Committees on which such director sits, and to review prior to meetings material distributed in advance for such meetings. Thus, the number of other public company boards and other boards (or comparable governing bodies) on which a prospective nominee is a member, as well as his or her other professional responsibilities, will be considered. Also, under our Corporate Governance Guidelines, there are no limits on the number of three-year terms that may be served by a director. However, in connection with evaluating recommendations for nomination for reelection, the Nominating and Governance Committee considers director tenure. We value diversity on a company-wide basis but have not yet adopted a specific policy regarding Board diversity, though we plan to comply with any applicable legal and listing requirements for director diversity.

Stockholder Recommendations for Nominations to the Board of Directors

The Nominating and Governance Committee will consider properly submitted stockholder recommendations for candidates for our Board of Directors who meet the minimum qualifications as described above. The Nominating and Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. A stockholder of record can nominate a candidate for election to the Board of Directors by complying with the procedures in Article I, Section 1.12 of our Amended and Restated Bylaws. Any eligible stockholder who wishes to submit a nomination should review the requirements in the Amended and Restated Bylaws on nominations by stockholders. Any nomination should be sent in writing to our Corporate Secretary, Sutro Biopharma, Inc., 111 Oyster Point Boulevard, South San Francisco, California, 94080. Submissions must include the full name of the proposed nominee, complete biographical information, a description of the proposed nominee’s qualifications as a director, other information regarding the nominee and proposing stockholder as specified in our Amended and Restated Bylaws, and certain representations regarding the nomination. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. These candidates are evaluated at meetings of the Nominating and Governance Committee and may be considered at any point during the

9

year. If any materials are provided by a stockholder in connection with the recommendation of a director candidate, such materials are forwarded to the Nominating and Governance Committee.

Additional information regarding the process for properly submitting stockholder nominations for candidates for membership on our Board of Directors is set forth below under “Stockholder Proposals to Be Presented at Next Annual Meeting.” In addition to satisfying the foregoing requirements under our Amended and Restated Bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees for the 2024 Annual Meeting of Stockholders must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act.

10

PROPOSAL NO. 1

ELECTION OF CLASS II DIRECTORS

Our Board of Directors is divided into three classes. Each class serves for three years, with the terms of office of the respective classes expiring in successive years. Directors and director nominees in Class II will stand for election at this meeting. The terms of office of directors in Class III and Class I do not expire until the annual meetings of stockholders to be held in 2024 and 2025, respectively. Our Nominating and Governance Committee recommended to our Board of Directors, and our Board of Directors nominated Ms. Matsui, Mr. Newell and Mr. Panek, each an incumbent Class II director, for election as Class II directors at the Annual Meeting. At the recommendation of our Nominating and Governance Committee, our Board of Directors proposes that each of the Class II nominees be elected as a Class II director for a three-year term expiring at the annual meeting of stockholders to be held in 2026 and until such director’s successor is duly elected and qualified or until such director’s earlier resignation or removal.

Each director will be elected by a plurality by the holders of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. This means that the three individuals nominated for election to the Board of Directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” one, two, three or all of the nominees or “WITHHOLD” your vote with respect to one, two, three or all of the nominees. A “WITHHOLD” vote will have the same effect as an abstention. Shares represented by proxies will be voted “FOR” the election of each of the Class II nominees, unless the proxy is marked to withhold authority to so vote. You may not cumulate votes in the election of directors. If any nominee for any reason is unable to serve, the proxies may be voted for such substitute nominee as the proxy holders, who are officers of our company, might determine. Each nominee has consented to being named in this proxy statement and to serve if elected. Proxies may not be voted for more than three directors.

Nominees to the Board of Directors

The nominees and their ages as of December 31, 2022 are provided in the table below. Additional biographical information for each nominee is set forth in the text below the table.

Name |

|

Age |

|

Class |

William J. Newell |

|

65 |

|

Class II Director |

Connie Matsui (1) |

|

69 |

|

Class II Director |

James Panek (1)(2) |

|

70 |

|

Class II Director |

(1) Member of our Nominating and Governance Committee

(2) Member of our Science and Technology Committee

William J. Newell has served as our Chief Executive Officer and a member of our Board of Directors since January 2009. Previously, he served as the President of Aerovance, Inc., a biotechnology company focused on respiratory diseases, from 2006 to 2007. Mr. Newell has also served as the Chief Business Officer and Senior Vice President at QLT Inc., in several senior management positions at Axys Pharmaceuticals, Inc., and has experience as a corporate lawyer. He currently serves on the boards of directors of Social Capital Suvretta Holdings Corp IV, Biotechnology Innovation Organization’s (BIO) Health Section, Emerging Company Section and is a member of BIO’s executive committee. He also serves on the board of directors of California Life Sciences (CLS) and is a member of CLS’s executive committee. Mr. Newell received an A.B. in Government from Dartmouth College and a J.D. from the University of Michigan Law School. We believe that Mr. Newell is qualified to serve on our Board of Directors because of his managerial experience with various biotechnology companies, including working with and serving in various executive positions in life sciences companies.

Connie Matsui has served as a member, and Chair, of our Board of Directors since June 2019 and brings over 18 years of general management experience in the biotechnology industry. From 2004 to 2009, Ms. Matsui served in various leadership positions at Biogen Idec, Inc., including as Executive Vice President, Knowledge and Innovation Networks and Executive Committee member. Prior to that, Ms. Matsui served in various leadership positions at IDEC Pharmaceuticals, a predecessor of Biogen Idec, including Senior Vice President; Collaboration Chair for the late-stage development and commercialization of rituximab (tradenames: Rituxan® and MabThera®) in partnership with Roche and Genentech; and Project Leader for Zevalin®, the first radioimmunotherapy approved by the U.S. FDA. Prior to entering the biotechnology industry, Ms. Matsui worked for Wells Fargo Bank in general management, marketing and human resources. Ms. Matsui currently serves on the boards of directors of Halozyme Therapeutics, Inc. and Artelo Biosciences, Inc., and has served on not-for-profit boards at the local, national and global level. Ms. Matsui received a B.A. and an M.B.A. from Stanford University. We believe that Ms. Matsui is qualified to serve on our Board of Directors because of her strong

11

biotechnology managerial and commercial experience, including her expertise with biopharmaceutical product development, sales and marketing and strategy and operations.

James Panek has served as a member of our Board of Directors since January 2020. Since 2011, Mr. Panek has served as an Independent Consultant for various biopharmaceutical companies, and currently serves as Acting COO and Director for CHO Plus, a privately owned biotechnology company. From 2010 to 2011, Mr. Panek served as interim President, Chief Executive Officer and Principal Financial Officer at DiaDexus, Inc. From 2007 to 2010, Mr. Panek served as President, Chief Executive Officer and Principal Financial Officer for VaxGen, Inc., now a subsidiary of DiaDexus, Inc. From 2002 to 2006, Mr. Panek served as Senior and Executive Vice President of VaxGen, Inc., and Co-Chief Executive Officer and Chairman of the Board for Celltrion Inc., then a VaxGen manufacturing joint venture in Inchon, Korea. In his role with Celltrion, Mr. Panek was responsible for the development and FDA licensure of the first large scale biopharmaceutical manufacturing facility in Asia. From 1982 to 2001, Mr. Panek served in various capacities with Genentech, Inc., including Senior Vice President, Product Operations, and Vice President, Manufacturing, Engineering and Facilities, where he led the development of the world’s largest biotechnology manufacturing facility and was responsible for all operations involved in supplying products for preclinical, clinical, and commercial use. Prior to joining Genentech, Mr. Panek spent six years with Eli Lilly in a variety of engineering and development positions. Mr. Panek previously served on the boards of directors of DiaDexus, Inc., VaxGen, Inc. and Celltrion Inc. Mr. Panek received a B.S. and an M.S. in Chemical Engineering from the University of Michigan. We believe that Mr. Panek is qualified to serve on our Board of Directors due to his extensive experience in operations, engineering, manufacturing and process and product development.

Continuing Directors

The directors who are serving for terms that end following the Annual Meeting and their ages as of December 31, 2022 are provided in the table below. Additional biographical information for each nominee is set forth in the text below the table.

Name |

|

Age |

|

Class |

Michael Dybbs, Ph.D.(1) |

|

48 |

|

Class I Director |

John G. Freund, M.D. (2) |

|

69 |

|

Class I Director |

Heidi Hunter(1)(2) |

|

64 |

|

Class I Director |

Jon Wigginton, M.D.(1)(3) |

|

61 |

|

Class I Director |

Joseph M. Lobacki (2)(3) |

|

64 |

|

Class III Director |

Daniel H. Petree (3)(4) |

|

67 |

|

Class III Director |

(1) Member of our Science and Technology Committee

(2) Member of our Audit Committee

(3) Member of our Compensation Committee

(4) Member of our Nominating and Governance Committee

Michael Dybbs, Ph.D., has served as a member of our Board of Directors since July 2018. Dr. Dybbs is currently a partner at Samsara BioCapital, where he has worked since March 2017. Prior to joining Samsara, Dr. Dybbs was a partner at New Leaf Venture Partners, where he worked from May 2009 until September 2016. Before joining New Leaf Venture Partners, L.L.C., Dr. Dybbs was a principal at the Boston Consulting Group. Dr. Dybbs currently serves on the boards of directors of Nkarta Therapeutics (NKTX) and several private companies. Dr. Dybbs previously served on the boards of directors of Versartis, Inc. and Dimension Therapeutics, Inc. Dr. Dybbs received an A.B. in biochemical sciences from Harvard College and a Ph.D. in molecular biology from University of California, Berkeley, where he was awarded a Howard Hughes Medical Institute fellowship. We believe that Dr. Dybbs is qualified to serve on our Board of Directors due to his experience in the life sciences industry and the venture capital industry, and his leadership and management experience.

John G. Freund, M.D., has served as a member of our Board of Directors since February 2014. Dr. Freund founded Skyline Ventures, a venture capital firm, in September 1997, where he served as a Managing Director beginning with its founding. Prior to founding Skyline, Dr. Freund served as Managing Director at Chancellor Capital Management, co-founded Intuitive Surgical, Inc., served in various positions at Acuson Corporation, most recently Executive Vice President, was a general partner at Morgan Stanley Venture Partners and co-founded the Healthcare Group in the Corporate Finance Department of Morgan Stanley. In 2016, Dr. Freund co-founded and was CEO of Arixa Pharmaceuticals, Inc. an antibiotic company, which was acquired by Pfizer in 2020. Dr. Freund currently serves on the boards of directors of Collegium Pharmaceutical, Inc., SI Bone, Inc. and fourteen U.S. registered investment funds managed by affiliates of Capital Group, Inc. Dr. Freund is a member of the Advisory Board for the Harvard Business School Healthcare Initiative. Dr. Freund previously served on the boards of directors of several publicly traded companies, including Proteon

12

Therapeutics, Inc. and XenoPort, Inc., where he was Chairman, Concert Pharmaceuticals, Inc., Tetraphase Pharmaceuticals, Inc., MAP Pharmaceuticals, Inc. and MAKO Surgical Corp. Dr. Freund received an A.B. in History from Harvard College, an M.D. from Harvard Medical School and an M.B.A. from Harvard Business School, where he was a Baker Scholar. We believe that Dr. Freund is qualified to serve on our Board of Directors because of his training as a physician and his extensive investment, business and board experience with public healthcare and biopharmaceutical companies.

Heidi Hunter has served as a member of our Board of Directors since November 2021. Ms. Hunter is the former President of Cardinal Health Specialty Solutions, a specialty healthcare business. Prior to Cardinal Health, Ms. Hunter served as Senior Vice President for UCB (Union Chimique Belge), a multinational biopharmaceutical company with a primary focus on neurology and immunology disorders from September 2015 to September 2020. Ms. Hunter also served as Senior Vice President and General Manager of Boehringer lngelheim, a pharmaceutical company, from 2011 to 2015. Prior to Boehringer lngelheim, Ms. Hunter held similar roles in sales and marketing at Ciba-Geigy (today part of Novartis) and Wyeth Pharmaceuticals LLC (today part of Pfizer) where she led their oncology business. Ms. Hunter also serves on the Board of Directors of Vicore Pharma Holding AB and is an advisory board member for MiGenTra. Ms. Hunter received a B.A in Economics from University of Michigan and a M.B.A. from University of Chicago - Booth School of Business. We believe that Ms. Hunter is qualified to serve on our Board of Directors because of her extensive biopharmaceutical managerial and commercial experience, including her expertise with clinical development, sales and marketing and strategy and operations.

Jon Wigginton, M.D., has served as a member of our Board of Directors since November 2020. Dr. Wigginton currently serves as President, Research and Development at Bright Peak Therapeutics. Most recently, he was Senior Advisor and Chairman of the SAB at Cullinan Oncology, Inc., having served previously as the Chief Medical Officer focused on developing oncology therapeutics, and as an advisor for MPM Capital, a healthcare investment firm from 2020 to 2021. From August 2013 to March 2020, Dr. Wigginton served as Senior Vice President, Clinical Development and Chief Medical Officer for MacroGenics, Inc., a clinical-stage biopharmaceutical company focused on discovering and developing innovative monoclonal antibody-based therapeutics. From 2008 to 2013, Dr. Wigginton served as the Therapeutic Area Head, Immuno-Oncology, Early Clinical Research and Executive Director, Discovery Medicine-Clinical Oncology at Bristol-Myers. From 2006 to 2008, Dr. Wigginton served as the Director of Clinical Oncology at Merck Research Laboratories. During his academic career, Dr. Wigginton has held several positions at the National Cancer Institute Center for Cancer Research, including Head of Investigational Biologics Section, Pediatric Oncology Branch. Dr. Wigginton previously served as President and as a member of the Board of directors of the Society for Immunotherapy of Cancer (non-profit). Dr. Wigginton received an M.D. and B.S. in Biology from the University of Michigan. We believe that Dr. Wigginton is qualified to serve on our Board of Directors because of his training as a physician and his extensive experience with clinical development and public healthcare and biopharmaceutical companies.

Joseph M. Lobacki has served as a member of our Board of Directors since February 2017. Mr. Lobacki is currently CEO of Artax, a private biopharmaceutical company developing treatments for autoimmune and inflammatory diseases focused on modulating the T-Cell Receptor response to antigen stimulation. Previously, Mr. Lobacki served as Executive Vice President and Chief Commercial Officer for Verastem, Inc., a biopharmaceutical company focused on the development and commercialization of therapies for the treatment of hematologic malignancies. From November 2016 to December 2017, Mr. Lobacki served as Chief Operating Officer for Crestovo, a clinical-stage biopharmaceutical company focused on microbiome therapies. From 2014 to 2016, Mr. Lobacki served as Chief Commercial Officer at Medivation, Inc., a biopharmaceutical company focused on development of novel therapies for the treatment of serious diseases. From 2012 to 2014, Mr. Lobacki also served as General Manager of Oncology and an independent biotechnology consultant at Idera Pharmaceuticals, Inc., a biopharmaceutical company focused on therapies for cancer and rare diseases. Previously, Mr. Lobacki served as Senior Vice-President and Chief Commercial Officer at Micromet, Inc., Senior Vice-President and General Manager of US Transplant and Oncology at Genzyme Corporation and in various other positions at SangStat Medical Corporation, Cell Pathways, Inc., Rhone-Poulenc Rorer and Lederle Laboratories. Mr. Lobacki previously served on the Board of Directors of Celator Pharmaceuticals Inc. Mr. Lobacki received a B.S. in Biology from Boston College and a B.S. in Pharmacy from the Massachusetts College of Pharmacy. We believe that Mr. Lobacki is qualified to serve on our Board of Directors because of his strong biopharmaceutical managerial and commercial experience, including his expertise with biopharmaceutical research and development, sales and marketing and strategy and operations.

Daniel H. Petree, has served as a member of our Board of Directors since August 2009. In April 2012, Mr. Petree co-founded Four Oaks Partners Consulting, LLC, which provided transaction advisory services to small and medium-sized life science companies until 2021 and in 2000, Mr. Petree co-founded P2 Partners, LLC, Four Oaks' predecessor in the same business. Before co-founding P2 Partners, Mr. Petree served as President and Chief Operating Officer of Axys Pharmaceuticals, Inc., Executive Vice President and Chief Financial Officer of Arris Pharmaceuticals, Incorporated and Vice President of Business Development at TSI Corporation and was a corporate and securities lawyer. Mr. Petree previously served on the boards of directors of Lpath, Inc., Biocept, Inc. and Cypress Bioscience, Inc. along with a number of privately held biotechnology companies. Mr. Petree received an A.B. in History and Political Science from Stanford University and a J.D. from the University of Michigan Law School. We believe that Mr. Petree is qualified to

13

serve on our Board of Directors because of his experience in the biotechnology industry, including structuring and negotiating pharmaceutical partnering arrangements and strategic transactions.

Family Relationships

There are no familial relationships among any of our directors and executive officers.

Board Diversity Matrix

Each of the Standing Committees of our Board of Directors has diverse representation. In addition, on our Board of Directors there are two directors who hold medical doctorates, one director who holds a doctorate in a scientific field, three directors who hold a Masters of Business Administration, and two directors who hold a juris doctorate. The table below provides certain highlights of the composition of our Board of Directors as disclosed by each current director. Each of the categories listed in the table below has the meaning set forth in Nasdaq Rule 5605(f).

Board Diversity Matrix |

||||||||

Total Number of Directors |

|

|

|

|||||

|

|

Female |

|

Male |

|

Non-Binary |

|

Did Not Disclose Gender |

Part I: Gender Identity |

|

|||||||

Directors |

|

2 |

|

7 |

|

|

|

|

Part II: Demographic Background |

|

|||||||

African American or Black |

|

|

|

|

|

|

|

|

Alaskan Native or Native American |

|

|

|

|

|

|

|

|

Asian |

|

1 |

|

|

|

|

|

|

Hispanic or Latinx |

|

|

|

|

|

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

|

|

|

|

White |

|

1 |

|

7 |

|

|

|

|

Two or More Races or Ethnicities |

|

|

|

|

|

|

|

|

LGBTQ+ |

|

|

|

|

|

|

|

|

Did Not Disclose Demographic Background |

|

|

|

|

|

|

|

|

Non-Employee Director Compensation

Our compensation arrangements for non-employee directors are reviewed periodically by our Compensation Committee and our Board of Directors. In addition, at the Compensation Committee’s direction, FW Cook, the Compensation Committee’s independent compensation consultant, provided a competitive analysis of director compensation levels, practices and design features as compared to the general market as well as to our compensation peer group. We last evaluated and adjusted compensation for our non-employee directors in 2021 and plan to do so again in 2023.

14

Our non-employee directors received the following compensation pursuant to a program adopted by our Board of Directors:

Non-employee directors are also reimbursed for reasonable expenses incurred in serving as a director, including travel expenses for attending meetings of our Board of Directors.

The following table sets forth the compensation earned by or paid to our non-employee directors for services provided during the year ended December 31, 2022. Mr. Newell, our Chief Executive Officer, received no compensation for his service as a director during 2022.

Name |

|

Fees Earned or Paid in Cash ($) |

|

|

Option Awards ($)(1) |

|

|

Total ($) |

|||

Connie Matsui |

|

$ |

85,000 |

|

|

$ |

56,510 |

|

|

$ |

141,510 |

Michael Dybbs, Ph.D. |

|

|

45,000 |

|

|

|

56,510 |

|

|

|

101,510 |

John Freund, M.D. |

|

|

50,000 |

|

|

|

56,510 |

|

|

|

106,510 |

Heidi Hunter |

|

|

55,000 |

|

|

|

56,510 |

|

|

|

111,510 |

Joseph Lobacki |

|

|

64,000 |

|

|

|

56,510 |

|

|

|

120,510 |

James Panek |

|

|

50,000 |

|

|

|

56,510 |

|

|

|

106,510 |

Daniel Petree |

|

|

52,000 |

|

|

|

56,510 |

|

|

|

108,510 |

Shalini Sharp |

|

|

60,350 |

|

|

|

56,510 |

|

|

|

116,860 |

Jon Wigginton, M.D. |

|

|

57,000 |

|

|

56,510 |

|

|

|

113,510 |

|

(1) The amounts reported in this column represent the aggregate grant date fair value of the stock options granted to our directors during the year ended December 31, 2022 as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification (FASB ASC) Topic 718. The assumptions used in calculating the aggregate grant date fair value of the stock options reported in this column are set forth in Note 11 to our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2022. The amounts reported in this column reflect the accounting cost for these stock options, and do not correspond to the actual economic value that may be received by our directors from the stock options. For information regarding the number of stock options held by each non-employee director as of December 31, 2022, see the table below.

Name |

|

Option Awards |

|

Connie Matsui |

|

|

72,076 |

Michael Dybbs, Ph.D. |

|

|

86,643 |

John Freund M.D. |

|

|

86,643 |

Heidi Hunter |

|

|

52,384 |

Joseph Lobacki |

|

|

102,988 |

James Panek |

|

|

73,000 |

Daniel Petree |

|

|

90,526 |

Shalini Sharp |

|

|

86,643 |

Jon Wigginton M.D. |

|

|

61,000 |

(2) Ms. Sharp resigned from our Board of Directors in April 2023.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE NOMINATED CLASS II DIRECTORS.

15

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has selected Ernst & Young LLP as our principal independent registered public accounting firm to perform the audit of our financial statements for the fiscal year ending December 31, 2023. Ernst & Young LLP audited our financial statements for the fiscal years ended December 31, 2022 and 2021. We expect that representatives of Ernst & Young LLP will be present at the Annual Meeting, will be able to make a statement if they so desire and will be available to respond to appropriate questions.

At the Annual Meeting, the stockholders are being asked to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. Although ratification by stockholders is not required by law, our Audit Committee is submitting the selection of Ernst & Young LLP to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. If this proposal does not receive the affirmative approval of a majority of the votes cast on the proposal, the Audit Committee would reconsider the appointment. Notwithstanding its selection and even if our stockholders ratify the selection, our Audit Committee, in its discretion, may appoint another independent registered public accounting firm at any time during the year if the Audit Committee believes that such a change would be in our best interests and the interests of our stockholders.

The following table presents fees for professional audit services rendered by Ernst & Young LLP for the audit of our annual financial statements for the years ended December 31, 2022 and 2021.

Principal Accountant Fees and Services

Fees Billed |

|

Fiscal Year 2022 |

|

|

Fiscal Year 2021 |

|

||

Audit fees(1) |

|

$ |

1,217,318 |

|

|

$ |

1,718,959 |

|

Audit-related fees(2) |

|

|

40,000 |

|

|

|

40,000 |

|

Tax fees(3) |

|

|

113,300 |

|

|

|

108,150 |

|

All other fees(4) |

|

— |

|

|

— |

|

||

Total fees |

|

$ |

1,370,618 |

|

|

$ |

1,867,109 |

|

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our Audit Committee generally pre-approves all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. Our Audit Committee may also pre-approve particular services on a case-by-case basis. All of the services relating to the fees described in the table above were approved by our Audit Committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NO. 2.

16

REPORT OF THE AUDIT COMMITTEE

The information contained in the following report of the Audit Committee is not considered to be “soliciting material,” “filed” or incorporated by reference in any past or future filing by us under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, unless and only to the extent that we specifically incorporate it by reference.

The Audit Committee has reviewed and discussed with our management and Ernst & Young LLP our audited financial statements as of and for the year ended December 31, 2022. The Audit Committee has also discussed with Ernst & Young LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (United States) and the U.S. Securities and Exchange Commission.

The Audit Committee has received and reviewed the written disclosures and the letter from Ernst & Young LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed with Ernst & Young LLP its independence.

Based on the review and discussions referred to above, the Audit Committee recommended to our Board of Directors that the audited financial statements as of and for the year ended December 31, 2022 be included in our Annual Report on Form 10-K for the year ended December 31, 2022 for filing with the U.S. Securities and Exchange Commission.

Submitted by the Audit Committee

Shalini Sharp, Chair

John Freund

Heidi Hunter

Joseph Lobacki

17

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of March 31, 2023, by:

each stockholder known by us to be the beneficial owner of more than 5% of our common stock;

each of our directors or director nominees;

each of our named executive officers; and

all of our directors and executive officers as a group.

Percentage ownership of our common stock is based on 60,161,801 shares of our common stock outstanding on March 31, 2023. We have determined beneficial ownership in accordance with the rules of the SEC, and thus it represents sole or shared voting or investment power with respect to our securities, and the information is not necessarily indicative of beneficial ownership for any other purpose. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares that they beneficially owned, subject to community property laws where applicable. We have deemed all shares of common stock subject to options or other convertible securities held by that person or entity that are currently exercisable or that will become exercisable within 60 days of March 31, 2023 to be outstanding and to be beneficially owned by the person or entity holding the option for the purpose of computing the percentage ownership of that person or entity but have not treated them as outstanding for the purpose of computing the percentage ownership of any other person or entity. Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Sutro Biopharma, Inc., 111 Oyster Point Boulevard, South San Francisco, California 94080.

|

|

Beneficial Ownership |

|||||||

Name of Beneficial Owner |

|

Number |

|

|

Percent |

||||

5% Stockholders |

|

|

|

|

|

|

|

|

|

Blackrock, Inc. (1) |

|

|

4,860,140 |

|

|

|

8.1 |

|

% |

BVF Inc. (2) |

|

|

3,160,416 |

|

|

|

5.3 |

|

% |

Suvretta Capital Management, LLC(3) |

|

|

5,565,099 |

|

|

|

9.3 |

|

% |

Rubric Capital Management LP(4) |

|

|

3,211,872 |

|

|

|

5.3 |

|

% |

Directors and Named Executive Officers: |

|

|

|

|

|

|

|

|

|

Connie Matsui (5) |

|

|

70,534 |

|

|

* |

|

|

|

Michael Dybbs, Ph.D.(6) |

|

|

85,101 |

|

|

* |

|

|

|

John G. Freund, M.D.(7) |

|

|

141,428 |

|

|

* |

|

|

|

Heidi Hunter(8) |

|

|

38,842 |

|

|

* |

|

|

|

Joseph Lobacki(9) |

|

|

101,446 |

|

|

* |

|

|

|

James Panek(10) |

|

|

71,458 |

|

|

* |

|

|

|

Daniel Petree(11) |

|

|

111,441 |

|

|

* |

|

|

|

Jon M. Wigginton, M.D.(12) |

|

|

55,458 |

|

|

* |

|

|

|

William J. Newell (13) |

|

|

1,519,847 |

|

|

2.5 |

|

% |

|

Trevor Hallam, Ph.D.(14) |

|

|

503,378 |

|

|

|

* |

|

|

Jane Chung, RPh(15) |

|

|

103,347 |

|

|

|

* |

|

|

All executive officers and directors as a group (17 persons) (16) |

|

|

4,406,441 |

|

|

|

6.9 |

|

% |

* Represents beneficial ownership of less than one percent.

18

19

EXECUTIVE OFFICERS

The following table provides information regarding our executive officers as of March 31, 2022:

Name |

|

Age |

|

Position(s) |

William J. Newell |

|

65 |

|

Chief Executive Officer and Director |

Trevor J. Hallam, Ph.D. |

|

64 |

|

President of Research and Chief Scientific Officer |

Edward Albini |

|

65 |

|

Chief Financial Officer |

Shabbir T. Anik, Ph.D. |

|

70 |

|

Chief Technical Operations Officer |

Anne Borgman, M.D. |

|

55 |

|

Chief Medical Officer |

Jane Chung, RPh |

|

52 |

|

Chief Commercial Officer |

Linda Fitzpatrick |

|

66 |

|

Chief People and Communications Officer |

Brunilda Shtylla |

|

48 |

|

Chief Business Officer |

Nicki Vasquez, Ph.D. |

|

60 |

|

Chief Portfolio Strategy & Alliance Officer |

William J. Newell has served as our Chief Executive Officer and a member of our Board of Directors since January 2009. Mr. Newell’s biographical information is set forth above under the heading “Proposal No. 1 Election of Class III Directors – Nominees to the Board of Directors.”

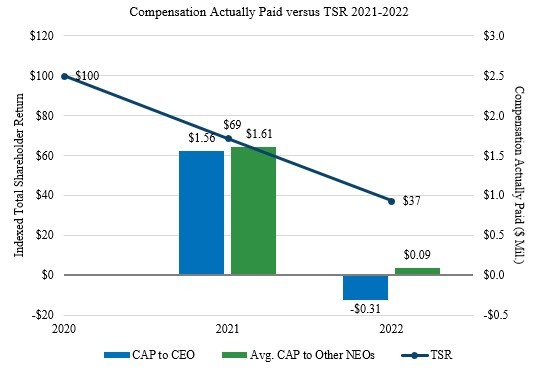

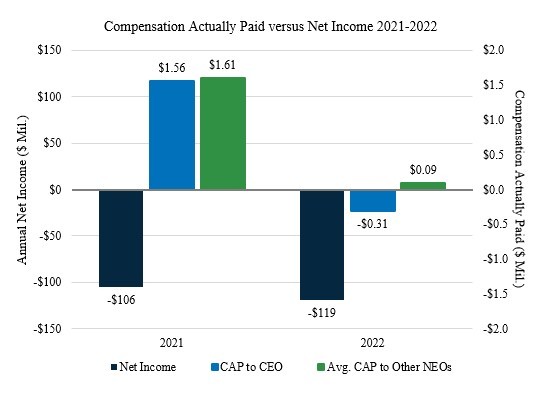

Trevor J. Hallam, Ph.D., has served as our Chief Scientific Officer since December 2010. He was promoted to President of Research and Chief Scientific Officer in 2021. Prior to joining us, Dr. Hallam was Executive Vice President of Research & Development at Palatin Technologies, Inc., and held several senior management positions in various pharmaceutical companies, including AstraZeneca PLC, SmithKline & French Laboratories, Ltd., Glaxo Group Research Ltd., Roche Research and Rhone-Poulenc Rorer. Dr. Hallam received a BSc (Hons) in Biochemistry from the University of Leeds and a Ph.D. in Biochemistry from Kings College, University of London. He then conducted post-doctoral training at the Physiological Laboratory, University of Cambridge.